When it comes to ESG and sustainability, data is everywhere – but making sense of it is a whole different story. That’s where Briink comes in. In this interview, the team shares how they’re using smart, domain-specific AI to cut through the noise, fight greenwashing, and help companies turn ESG compliance into real impact

Could you please explain the core innovation of your startup? Which specific problem in the field of sustainability or environmental protection do you solve with your technology or approach?

Briink’s core innovation is applying domain-specific AI to automate ESG document analysis and verification at enterprise scale. We aim to help advisory, audit, financial firms, and supply chain actors in analyzing sustainability data across thousands of companies.

We turn unstructured ESG disclosures — from reports, policies, websites, and questionnaires — into structured, traceable insights, enabling fast, accurate, and consistent analysis. Our tools are built for large-scale deployments, whether for regulatory compliance, supply chain due diligence, or investment screening.

By reducing the time, cost, and subjectivity of ESG assessments, Briink empowers organizations to scale their sustainability efforts, fight greenwashing, and improve decision-making across their networks.

What distinguishes your solution from existing technologies or approaches? What unique added value do you offer?

Briink combines advanced ESG-specific AI models, intelligent agents, and deep domain expertise to automate one of the most time-consuming challenges in sustainability: making sense of unstructured data at scale.

Unlike generic tools or ESG data aggregators, we focus on extracting high-quality, traceable insights directly from complex documents, like supplier reports, audits, and contracts, using models trained specifically on ESG language and logic. Our AI agents then automate entire ESG workflows: answering questionnaires, checking for inconsistencies, flagging compliance risks, and benchmarking against frameworks.

This allows advisory, audit, financial firms, and supply chain actors to scale ESG assessments across hundreds if not thousands of companies, reducing manual effort, improving accuracy, and accelerating time-to-insight, all while building a verifiable audit trail.

On which technology is your innovation based? Are there any current research findings or partnerships that drive your development?

Briink is built on a custom Retrieval-Augmented Generation (RAG) architecture, enhanced by domain-specific prompting, multi-step reasoning chains, and complex agents trained specifically on ESG data and disclosure patterns.

Unlike general-purpose LLM tools, our models are fine-tuned to understand sustainability frameworks and extract traceable, high-precision insights from unstructured documents like reports, audits, and supplier disclosures. Our agents replicate the workflows of real ESG analysts — from identifying gaps and inconsistencies to completing assessments and benchmarking across portfolios and supply chains.

Our development is guided by both cutting-edge AI research and close partnerships with ESG leaders, including Climate Bonds Initiative, Novata, Holtara, and corporates like Continental. These partnerships ensure that our technology is grounded in real-world needs and continuously improved through hands-on feedback from advisory, financial, and supply chain teams operating at scale.

How do you assess the scalability of your solution? What steps are you taking to achieve market readiness and establish a sustainable business model?

Briink is built for scalability, with a modular, flexible AI architecture that powers both our web-based platform and API offering. This allows us to support ESG teams of all sizes — from boutique advisory firms to global enterprises — with solutions that scale across entire portfolios or supply chains.

We offer a SaaS subscription model for smaller teams and a flexible API and enterprise licensing model for high-volume or embedded use cases. This dual approach enables fast adoption and long-term integration.

To ensure market readiness, we’ve:

- Invested significantly in data privacy, compliance, and security

- Built out our go-to-market and customer success teams

- leveraged our flexible architecture to rapidly adapt to the evolving needs of ESG teams and frameworks

What measurable positive impact does your technology or approach have on the environment? Can you provide specific examples or key figures?

Briink helps accelerate climate action by dramatically reducing the time and cost of ESG and sustainability assessments, enabling companies to monitor and improve environmental performance at scale.

Our clients use Briink to assess hundreds to thousands of suppliers or portfolio companies, identifying risks such as missing emissions disclosures, non-aligned climate targets, or unsustainable sourcing practices, all within hours instead of weeks. For example:

One client reduced manual review time by 80%, enabling their team to reallocate efforts toward decarbonization strategy. Another used Briink to screen over 1,000 supplier reports for key ESG risks in less than two weeks, a process that would have taken months manually.

By improving data quality and consistency, our tools also help prevent greenwashing, ensuring that sustainability claims are evidence-based and auditable.

The broader environmental impact: faster identification of risks, more accountability in supply chains, and better decisions on where to focus sustainability investments. In a world where climate disclosure is becoming mandatory, our technology enables compliance (and action) at scale.

Where do you see your startup in the next three to five years? What long-term sustainability goals are you pursuing?

In the next 3–5 years, we aim to establish Briink as the leading AI platform for ESG analysis and verification, powering thousands of assessments each month across advisory, financial, and supply chain ecosystems.

We envision a future where ESG data is no longer a bottleneck, but a real-time, verifiable asset, enabling better decisions, stronger compliance, and faster action on climate goals. Our long-term goal is to make high-quality ESG analysis accessible at scale, so that companies of all sizes can transition toward sustainability with confidence.

How do you perceive the competitive landscape in the ESG GreenTech sector? What opportunities and challenges do you see specifically for startups?

The GreenTech sector is growing rapidly, driven by regulation, investor pressure, and a global push for sustainability. While the market is becoming more crowded, especially in areas like carbon accounting and ESG data aggregation, we see a major gap in domain-specific AI solutions that can handle unstructured, high-volume ESG data with precision and traceability.

For startups like Briink, the key opportunity lies in agility: we can move faster than incumbents to build flexible, AI-native infrastructure tailored to ESG use cases. We’re also seeing growing demand from large firms for specialized, verifiable tools, especially in supply chain risk, reporting automation, and ESG assurance.

The main challenges are:

- Long sales cycles with enterprise clients

- Navigating a still-maturing regulatory landscape

- Competing against generic AI tools that may promise a lot but lack ESG depth or explainability

Startups that combine technical excellence, regulatory relevance, and vertical focus will be well-positioned. For Briink, that means staying close to our customers, building high-performance ESG workflows, and proving impact at scale. Not just potential.

What role do partnerships and collaborations with other companies, research institutions, or organizations play in your success? Are there any specific examples?

Partnerships are essential to Briink’s growth and impact. Our platform is designed to complement, not replace, existing tools in the ESG ecosystem, which is why we invest heavily in API-based integrations with key players in the space.

We work closely with partners like Novata, Positive Luxury, and Holtara to embed our AI capabilities directly into their platforms, enabling clients to automate ESG assessments and verification within the systems they already use. These collaborations help us scale our reach, adapt to diverse workflows, and co-create solutions that meet real-world demands.

We also stay connected to the research community through our involvement in Climate Change AI, ensuring our development remains grounded in both cutting-edge research and practical ESG challenges.

How are you financing your growth? What milestones have you already achieved, and what further funding rounds are you potentially planning?

We’ve financed our growth through over €7 million in funding from leading venture capital funds and angel investors who share our vision of using AI to accelerate the sustainability transition.

This funding has enabled us to:

- Develop and launch our AI-powered ESG platform and modular API infrastructure

- Onboard over 100 enterprise clients across advisory, audit, financial services, and supply chain

- Build integrations and partnerships with key players such as Baker Tilly, Continental, Holtara, Positive Luxury, and others.

- Scale large, production-level deployments and establish strong product-market fit

- Grow a highly skilled team across AI, engineering, product, sales, and customer success

As we continue to expand internationally and deepen our enterprise footprint, we are planning to raise a Series A round to accelerate product development, hiring, and strategic partnerships.

How does the current regulatory environment in the ESG GreenTech sector affect your business activities? Do you see opportunities or challenges here?

Regulation is a clear driver of demand for our solution. The emergence of ESG disclosure requirements (particularly in the EU through frameworks like CSRD and CSDDD) is pushing companies to gather, verify, and report ESG data at a level of scale and rigor that manual processes simply can’t handle.

That said, recent developments, such as uncertainty around aspects of the Omnibus directive, highlight the importance of flexibility. The ESG landscape is evolving, and our modular, adaptive AI architecture is designed to keep up, allowing us to respond quickly to change and support clients regardless of how regulations develop.

At the same time, this regulatory tightening validates our mission: helping organizations automate ESG workflows, improve data quality, and reduce the burden of compliance.

What importance do you attach to participating in events like the GreenTech Festival for the development of your startup? What specific benefits – for example, in terms of networking, visibility, or new partnerships – do you expect or have you already experienced?

Events like GTF are invaluable. They offer direct access to decision-makers, potential partners, and fellow innovators. For us, it’s not just about visibility, it’s about staying close to the pulse of the market, getting real-time feedback, and forming the connections that turn into long-term collaborations.

What personally motivated you to found a ESG GreenTech startup? What passion drives you?

My co-founder and I had been building AI tools for years, particularly in high-stakes, document-heavy industries like audit and assurance. Around the time the EU Green Deal was gaining momentum, we realized that ESG and sustainability were becoming the foundation of a new knowledge economy. Unfortunately, the tools available to those doing the work were outdated, manual, and painfully slow.

What motivated us wasn’t just the technology, it was the chance to apply AI where it actually matters. The climate crisis is the defining challenge of our time, and there’s no energy transition, no net-zero future, without radical improvements in transparency, accountability, and data quality.

What drives me personally is the belief that if we can make ESG analysis faster, cheaper, and more reliable, we can unlock impact at scale; Helping thousands of professionals make better decisions, hold companies accountable, and accelerate the shift to a more sustainable economy.

Briink is our way of turning that conviction into action.

What important experiences have you gained so far in founding and building your ESG GreenTech startup? What advice would you give to other founders in this field?

One of the most important lessons we’ve learned is that building in GreenTech requires both domain credibility and adaptability. ESG is a complex, evolving field, and earning the trust of clients like auditors, financial institutions, or supply chain teams means going deep on their workflows and understanding the nuances of regulation, not just building good tech.

We also learned that speed matters, but alignment matters more. Some of our biggest wins came not from chasing short-term revenue, but from working closely with forward-thinking partners who saw us as long-term collaborators. That patience and focus has been crucial.

For other founders in this space, my advice is:

- Pick a real pain point, don’t just ride the ESG wave, solve something specific and painful.

- Talk to users constantly — their feedback will shape your product far more than any roadmap.

- Build for flexibility, the regulatory and political landscape will shift; your tech and business model need to adapt with it.

- Most of all: stay mission-driven. Climate and sustainability work is hard and often slow, but it’s some of the most meaningful work you can do as a founder.

How do you see the future of the ESG GreenTech sector as a whole? Which trends and developments do you consider particularly relevant?

The GreenTech sector is moving from a phase of experimentation to scale. In the next few years, we’ll see sustainability shift from a niche function to a core part of business operations, driven by regulation, investor pressure, and competitive advantage. Three trends stand out:

Data accountability and verification will become central. Companies won’t just report ESG data, they’ll need to prove it. That’s why AI-powered solutions that offer traceability, auditability, and precision will play a major role in scaling sustainability efforts.

Supply chain transparency is emerging as a critical focus. Companies will need tools that go beyond their own operations and help them assess ESG risks deep into their supplier networks.

Automation of ESG workflows will accelerate. The scale and complexity of ESG reporting requirements make manual approaches unsustainable. We expect to see a wave of agent-based systems and vertical AI tools purpose-built for sustainability professionals.

Overall, the GreenTech sector will evolve from compliance-focused tools to decision-enabling infrastructure, and the winners will be those who can combine technical excellence with deep domain insight.

In your opinion, what makes the GreenTech Festival a particularly valuable platform for GreenTech startups compared to other events? Are there specific aspects you would like to highlight?

GTF brings together a unique mix of corporates, innovators, and policymakers, which is rare. It’s one of the few events where you can spark a commercial partnership and a regulatory insight in the same day. That blend of strategic and practical conversations is what makes it stand out, and why we’re always excited to attend.

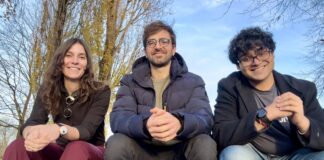

Photo/Source: Briink