The Startup CFO offers fractional CFO and consulting services for early-stage startups in 20+ countries

Please introduce yourself and The Startup CFO to our readers!

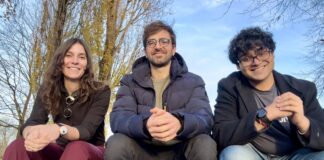

I’m Jaime Medina, CEO at The Startup CFO. I have a background in Physics, I studied a Master’s degree in New York, and started my professional career at McKinsey & Company as a management consultant. I made the leap to the startup world by setting up the financial department of Ontruck, where I loved the startup culture and the ability to impact the ecosystem. Later on, I worked as CFO at Geoblink and, at the same time, continued to receive requests for help from different startups to manage their finances as a freelancer. In 2020, I decided to set up and scale The Startup CFO, a project that is a reference in financial management for startups.

The Startup CFO is a project launched by entrepreneurs to help the best entrepreneurs. Our goal is to provide all the financial knowledge we have acquired while working with over 200 startups, so that the success of our work translates into the generation of innovation and employment. We are a team of 25+ professionals that offer fractional CFO and consulting services for early stage startups in 20+ countries.

So why did you decide to start a company?

I started this project as a freelancer in 2018. At that time, I was working as a CFO for a startup in an early stage, which did not require all my available time. So, I decided to acquire more clients and offer my services as an external consultant. Eventually, I managed to work with 12 clients at the same time as a freelancer. That’s when I realized the market niche I had found, and I founded The Startup CFO in January 2020 and try to scale the business.

What is the vision behind The Startup CFO?

Our goal is to be the main strategic partner that startups in the ecosystem count on. We want to help startups have the appropriate control and financing to scale their project. We believe this is the best way we can help improve the world, working with the best entrepreneurs for innovation and job creation.

From the idea to the launch, what have been the biggest challenges so far and how have you financed yourself?

Starting as a freelancer while I had a full-time job was time consuming but relatively easy to handle. The first three years after I decided to try to scale the model were much harder, as they involved delivery to the clients, team training and company building. Keeping an outstanding delivery while delegating in more junior roles was very challenging, and we had to learn many lessons the hard way. Fortunately, we past that stage and we are now growing in a scalable and organic way.

We haven’t needed any external funding as our model is not capital intensive. In fact, our challenge is to productise our service as much as possible, but it’s still services and no big investment in technology development was needed.

What is The Startup CFO’s target group?

We have had more than 200 clients across all of our B2B business lines. Our clients are from all sectors (education, medicine, mobile applications, industrial technology, e-commerce, etc.). The most common format is B2B SaaS, as it is one of the most common startup models in the market due to the scalability offered by these business models. We have had clients with a presence in more than 20 countries, including the United States, Germany, UK, Senegal, Mexico, Sweden, or Finland.

We are specialists in early-stage startups, from the moment they raise their first funding round until they raise 10-15 million euros, when they usually need to hire a full-time CFO. For very early stage startups we focus on achieving their first financing round and in later stages we become part of the team as fractional CFOs.

How does The Startup CFO work? What are the advantages? What differentiates you from other players?

At The Startup CFO we get involved as another member of the team. We believe in getting deeply involved in our clients’ businesses, making important decisions, and advising based on a lot of experience. We offer a complete range of services that includes consulting, legal, and management, allowing the entrepreneur to have everything integrated. Our positioning is always premium, offering a top-level team that is very involved. We believe that in such sensitive financial matters, it is worth betting on the best solution. The feedback we’ve received from our clients and investors is that we’re deeply involved and provide valuable insights and advice.

The Startup CFO, where does the journey lead to? Where do you see yourself in five years?

We already opened our second office in Berlin and the first months look very promising. If our launch is successful, we will expand our service offering in the DACH region and consider opening our next international branch. Ideally, in five years we will already have consolidated our presence and our offering in most of the world’s main startup hubs, but there is still a huge job ahead.

At the end: Which 3 tips would you give to aspiring founders?

The first one, for most young talented aspiring entrepreneurs, is simply to quit their jobs and try: in the worst case scenario they will look for another full-time job one year later, and in the way they will have learnt a lot and made tons of new connections. The second one is to really think about their risk-return profile and consider whether they want to follow the typical VC path or a more sustainable growth: it is absolutely fine to grow slowly and steadily while keeping 100% of the ownership of your company and may be more suitable for your priorities. The third one is to be prepared for what’s coming: it’s probably the first time you start a company and there are many mistakes that you can avoid if you surround yourself with specialists that have done it before.

Thank you Jaime Medina for the Interview

Statements of the author and the interviewee do not necessarily represent the editors and the publisher opinion again.